The care you deserve

Mental Health Issues Are Hard Enough. These Apps Make it Easier For Those in the Margins

We highlight some of the mental health apps and platforms that cater to specific marginalized communities.

If you’re looking to upgrade your finance habits, you’re in the right place

With so many budgeting apps floating around, we take a look at nine of our favorites and what special specs they’ve got to offer.

The hype around this new decade has us wanting to set more than just fitness goals.

Whether you’re looking to launch a business, set your freelance aspirations into motion, pay off student debt, or buy a house, budgeting and smart financial habits may help you get closer to your unique version of financial freedom.

With debt and student loans at the forefront of our consciousness, (the total student loan burden in the US is now about $1.6 trillion—and rising), it’s important to think about how to build a game plan towards more sustainable financial strategies. And though a lot of the financial stressors affecting individuals and workers today are rooted in how our systems are currently set up, there are still personal practices that can help.

Pretty much everyone wants to grow their savings and minimize debt, but knowing where to start and which tools you can trust is a separate conversation. Whether you’re looking for apps to help make your first investment moves, save for specific life goals, juggle multiple currencies as you pursue a digital nomad lifestyle, or make saving fun by rewarding new, positive habits, we’ve got your bases covered.

With so many budgeting apps floating around, we were curious to take a look at which ones are user favorites, and what specs they’ve got to offer. If you’re looking to upgrade your finance habits and get a solid grasp on budgeting, then you’re in the right place. Keep on reading to find out why these nine apps made the cut, and get ready to take a much-needed trip to your app store so you can save more in 2020.

Mint has remained one of the best-loved budgeting apps for years because it covers so many essential bases while remaining versatile and expertly detailed. Thanks to its simple and intuitive design, the app is a popular budgeting tool for personal finance newbies or those looking for a more thorough understanding of their spending habits. Users get automatically updated records of transactions and overall spending, with the added benefit of being able to create personalized categories, monitor bill tracking, set budgets, keep track of credit score fluctuations, and more. Mint is free and available for both iOS and Android.

Picture this: you’re scrolling through your monthly spending and, to your horror, see that pesky subscription or membership you forgot about signing up for, or thought was cancelled months ago. You find yourself wondering how you’re ever going to get a handle on all of your bills and subscriptions―enter Clarity. This app lets users link their financial accounts from an array of thousands of institutions. From there, Clarity automatically identifies recurring expenses through an easy-to-follow pie chart, helping individuals see which categories are setting them back (hello, “Dining Out”), cancel accounts that impede their savings, and make overall smarter financial decisions. Another advantage of using this app is the option to transfer and save money (interest-free) through an FDIC insured account. It’s free, has a neat design, and is available for iOS and Android.

If you’re a nomad, Lunch Money might be the app for you. Of all the budget tools surfacing as phone apps, Lunch Money is one of the few to offer comprehensive multi-currency support for your finances, so you can easily track spending—from any country. Choose your home currency from over 90 options, and from there, no matter what currency you’re spending in, Lunch Money will add it all up in the currency of your choice. Beyond this cool feature, the app helps you to set a budget, run transaction analytics to gain insight on your spending, track recurring expenses, and more. Lunch Money utilizes two-factor authentication and data encryption, so you can rest easy. No credit card required and you can try it free for 14 days. Only catch? Currently available only on the web.

If you’re not pressed about the bigger-picture logistics of your budget, the PocketGuard app might be enough to help you stay in the moment, at least financially speaking. Since financial independence often boils down to feeling secure about how much you can spend on day-to-day purchases, PocketGuard runs the numbers so users know how much disposable income they’re working with after bills, spending goals, and savings are taken into consideration. The app relays frill-free information about how much money is left “in pocket” on a daily, weekly, or monthly basis. If desired, you can also get down to the nitty-gritty by categorizing spending categories: shopping, groceries, restaurants, etc. PocketGuard is totally free and can be installed on iOS, Android, or used online.

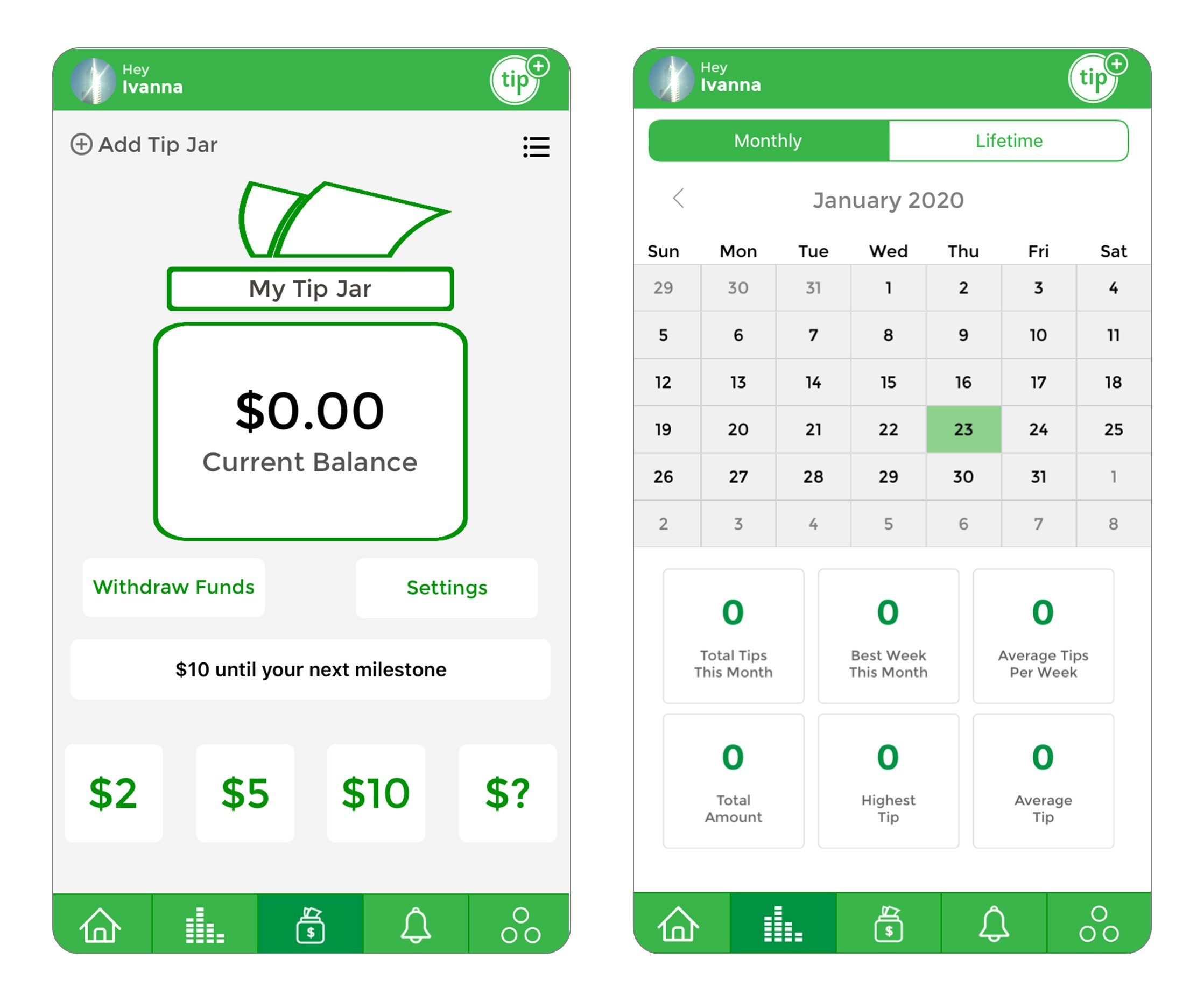

We’ll admit, finance can sometimes feel like a chore. Reviewing numbers, graphs, and charts can be helpful, but leave you yearning for simpler days of piggy banks and savings jars. If you’re looking to infuse a little levity into your finance habits, Tip Yourself is a great place to start. Users get to “tip” themselves a dollar amount for any special reason they choose―hitting the gym, skipping an impulse purchase, practicing an instrument, or any other positive habit you can conjure up. The encrypted app pulls money from your checking account with no transaction or service fees. Tip Yourself is available through iOS and Android. The app is free with the option of upgrading to pro, which includes various advanced features like managing up to 10 tip jars! That’s a lot of good habits.

Digit is the easiest app for people who want a quick, easy, and fun way to track their savings. Digit monitors our spending habits and pulls small sums you can afford from your account periodically to help you reach specific savings goals. After calculating your income, bills, spending habits, and checking balance, Digit snags whatever is non-essential and stores it in savings categories, such as a rainy day fund or any other savings goal you desire, that max out at the amount you set. It’s simple. Label your goal, match it up to your preferred emoji, and let Digit work its magic. Though this app won’t teach you how to save, it will do so passively so you don’t have to think twice about it. You can even “boost” savings if you want to speed up the process. The app offers $5 referral bonuses, 1% annual savings bonuses, and a text service―making this app a millennial go-to. Get it on iPhone, Android, or Apple Watch.

Acorns is equal parts investment and saving. For every purchase you make on a debit or credit card (dealer’s choice), Acorns will round your purchase up to the nearest dollar and invest the change into an investment portfolio. If you want to accelerate your investment, the app lets you set up manual lump sums or recurrent deposits. Acorns is the perfect app for those who are not-yet-versed in the world of investment―with their largest user pool comprised of millennials and college students―for $1 a month. Get it through the website, Android, or iPhone.

Goodbudget is a solid app based on a simple concept you may have learned from your grandparents: envelope saving. This method requires dividing all your money into separate envelopes for each of your spending categories―bills, shopping, groceries, events, etc. Toss a stack of cash into the envelope for each category and you’re set. Goodbudget uses virtual envelopes that let you label and specify how you want to break down your savings. Beyond basic expenses, you can also set aside money for vacations, gifts, and more. One drawback is that all transactions have to be categorized manually, but the bright side is that a more involved process will help you develop a fuller understanding of your spending. Start with the free plan, or upgrade. Available for iPhone, Android, and web.

Sign me uppp

Sign up for our newsletter: Supernews.